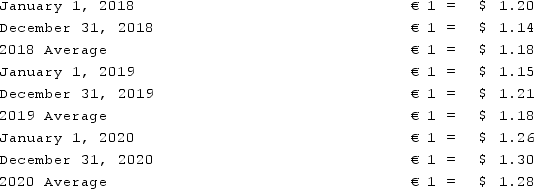

A subsidiary of Reynolds Inc., a U.S. company, was located in a foreign country. The local currency of this subsidiary was the Euro (€) while the functional currency of this subsidiary was the U.S. dollar. The subsidiary acquired Equipment A on January 1, 2018, for €250,000. Depreciation expense associated with Equipment A was €25,000 per year. On January 1, 2020, the subsidiary acquired Equipment B for €150,000 and Equipment B had associated depreciation expense of €10,000. The subsidiary owned no other depreciable assets. Currency exchange rates between the U.S. dollar and the Euro were as follows:  What amount would have been reported for total equipment owned by the subsidiary in Reynolds's consolidated balance sheet at December 31, 2018?

What amount would have been reported for total equipment owned by the subsidiary in Reynolds's consolidated balance sheet at December 31, 2018?

Definitions:

Membership Publications

Publications, such as newsletters or journals, provided exclusively to the members of an organization or club.

Firearms Legislation

Laws and regulations pertaining to the manufacture, sale, possession, and use of firearms.

NRA

National Rifle Association, a US organization advocating for gun rights and firearm ownership.

Direct Technique

A method used by interest groups to influence government officials directly, through lobbying or other forms of direct contact.

Q4: In translating a foreign subsidiary's financial statements,

Q10: Paris, Inc. owns 80% of the voting

Q21: Gale Co. was formed on January 1,

Q28: A partnership began its first year of

Q29: Teapot, Ltd. is a foreign company that

Q31: Gregor Inc. uses the LIFO cost-flow assumption

Q34: Oscar, Ltd. is a British subsidiary of

Q83: Assume the partnership of Dean, Hardin, and

Q89: Which of the following statements is correct

Q97: On January 1, 2021, Harrison Corporation spent