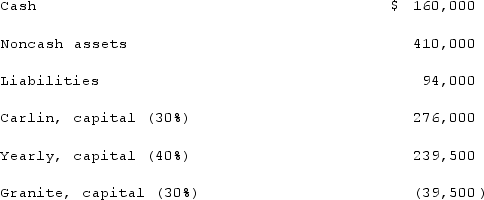

As of January 1, 2021, the partnership of Carlin, Yearly, and Granite had the following account balances and percentages for the sharing of profits and losses:  The partnership incurred losses in recent years and decided to liquidate. The liquidation expenses were expected to be $20,000.What would be the maximum amount Granite might have to contribute to the partnership to eliminate a deficit balance in his account?

The partnership incurred losses in recent years and decided to liquidate. The liquidation expenses were expected to be $20,000.What would be the maximum amount Granite might have to contribute to the partnership to eliminate a deficit balance in his account?

Definitions:

Allocation Base A

An allocation base is a measure or quantity, such as machine hours or labor costs, used to assign indirect costs to different products or services.

Allocation Base B

A criterion or standard used to distribute overhead costs among various cost objects.

Step-down Method

A cost allocation method used in accounting to distribute overhead costs to various cost objects based on a hierarchical sequence of allocation bases.

Custodial Services

These are services related to the maintenance and cleaning of buildings and facilities.

Q8: What is the definition of the term

Q13: Bassett City issues bonds in the amount

Q22: On a statement of functional expenses for

Q43: What financial report would be prepared for

Q46: A partnership began its first year of

Q65: On August 21, 2021, Carbondale City transferred

Q67: How do the balance sheet and statement

Q73: What is the purpose of government-wide financial

Q81: Why are the terms of the Articles

Q250: Which of the following is a positive