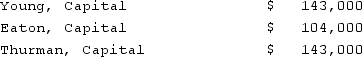

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Thurman's total share of net income for the second year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Thurman's total share of net income for the second year?

Definitions:

Colposcopy

A diagnostic examination to visualize the cervix through a colposcope.

Pap Smear

A cervical screening procedure to detect the presence of precancerous or cancerous cells on the cervix.

Digestive System

The complex group of organs and glands that processes food, absorbs nutrients, and eliminates waste products from the body.

Chancre

A painless ulcer, particularly associated with the primary stage of syphilis, serving as an early marker of the disease.

Q5: What occurs in the accounting records for

Q11: Which of the following statements regarding Management's

Q17: The disadvantages of the partnership form of

Q31: What is shelf registration?

Q32: What is the difference between a liquidation

Q49: How is the presentation of a balance

Q69: If a subsidiary is operating in a

Q70: What is blue sky legislation?

Q73: Which one of the following forms is

Q78: Which of the following type of organization