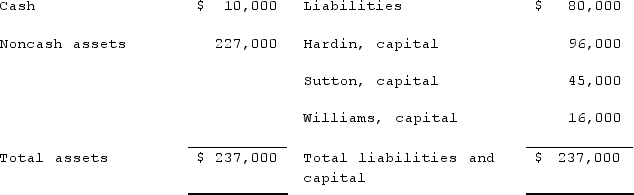

Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.The following balance sheet has been produced:  During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.- Liquidation expenses of $12,000 are paid. No further expenses are expected.- Safe capital distributions are made to the partners.- Payment is made of all business liabilities.- Any deficit capital account balances are deemed to be uncollectible.Compute safe cash payments after the noncash assets have been sold and the liquidation expenses have been paid.

During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.- Liquidation expenses of $12,000 are paid. No further expenses are expected.- Safe capital distributions are made to the partners.- Payment is made of all business liabilities.- Any deficit capital account balances are deemed to be uncollectible.Compute safe cash payments after the noncash assets have been sold and the liquidation expenses have been paid.

Definitions:

Suicide Risk

The likelihood that an individual will attempt or complete suicide.

Tricyclics

A class of antidepressant drugs that work by inhibiting the reuptake of neurotransmitters like serotonin and norepinephrine.

Mood Disorders

A category of mental disorders involving persistent disturbances in a person's mood, causing significant impairment in daily life; includes major depressive disorder and bipolar disorder.

Cohort Effect

Differences among groups of people caused by their being born in different time periods.

Q8: The City of Ibiza maintains a collection

Q20: Ginvold Co. began operating a subsidiary in

Q22: Fiduciary funds are<br>A) Funds used to account

Q29: The executor of Danny Mack's estate has

Q36: A partnership held three assets: Cash, $13,000;

Q40: When preparing a consolidation worksheet for a

Q46: Which of the following statements is true

Q55: In the market for factors of production,

Q90: How is accounting for a partnership different

Q273: Which of the following is a microeconomic