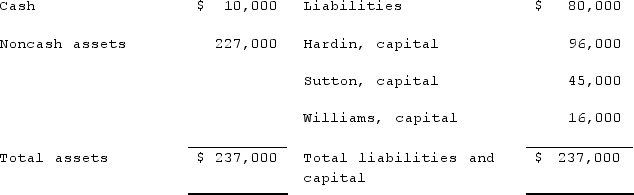

Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.The following balance sheet has been produced:  During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.- Liquidation expenses of $12,000 are paid. No further expenses are expected.- Safe capital distributions are made to the partners.- Payment is made of all business liabilities.- Any deficit capital account balances are deemed to be uncollectible.Develop a predistribution plan for this partnership, assuming $12,000 of liquidation expenses are expected to be paid.

During the liquidation process, the following transactions take place:- Noncash assets are sold for $116,000.- Liquidation expenses of $12,000 are paid. No further expenses are expected.- Safe capital distributions are made to the partners.- Payment is made of all business liabilities.- Any deficit capital account balances are deemed to be uncollectible.Develop a predistribution plan for this partnership, assuming $12,000 of liquidation expenses are expected to be paid.

Definitions:

Career Goals

Objectives or benchmarks that individuals set for their professional development and advancement.

Career Development

The progression and growth of an individual’s career over time, often involving education, training, and work experience.

Occupation

The job or profession that a person engages in to earn a living or fulfill a role in society.

Career Development

The progression and growth of an individual's professional life, often involving training, education, and various roles.

Q1: On a statement of financial affairs, a

Q11: Which one of the following registration statement

Q17: The disadvantages of the partnership form of

Q30: What are the steps to be taken

Q31: On January 1, 2021, Kenneth City purchased

Q38: When are unconditional promises to give recognized

Q41: The most recent FASB-IASB convergence projects include:<br>A)

Q44: Filings with the SEC are divided generally

Q45: How does a not-for-profit entity account for:

Q173: In the market for factors of production,