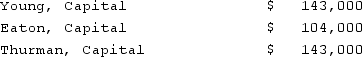

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Young's Capital account at the end of the second year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Young's Capital account at the end of the second year?

Definitions:

Intuition

The capacity to grasp or comprehend something right away, without requiring conscious thought.

Managers

Individuals responsible for planning, leading, organizing, and controlling resources to achieve organizational goals efficiently and effectively.

Self-esteem

A person's overall subjective assessment of their own worth and capabilities.

Deescalate

The process of reducing the intensity of a conflict or potentially volatile situation, aiming to prevent it from worsening or leading to aggressive outcomes.

Q5: In an executor's accounting for an estate,

Q7: During a reorganization, cash reserves tend to

Q10: What accounting transactions are not recorded by

Q26: Which statement is false regarding the Public

Q45: During a partnership liquidation, how are gains

Q50: Foreign companies whose stock is listed on

Q58: The Henry, Isaac, and Jacobs partnership was

Q59: Which statement below is not correct for

Q60: A demonstrative legacy is a<br>A) Gift of

Q88: A partnership began its first year of