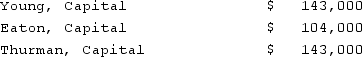

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Eaton's Capital account at the end of the first year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Eaton's Capital account at the end of the first year?

Definitions:

Inventory Management System

A technology-based approach that tracks inventory levels, orders, sales, and deliveries to ensure that the right product is available at the right time.

Seasonality

The occurrence of fluctuations in demand, production, or other variables based on seasonal trends or patterns, often predictable within a calendar year.

Inventory

The total amount of goods or materials held in stock by a business, crucial for meeting customer demand and ensuring smooth operations.

Classification Method

A systematic approach in categorizing data or items based on shared characteristics or criteria.

Q6: What are some examples of accounting treatments

Q20: Which group of government financial statements reports

Q22: On a statement of functional expenses for

Q32: For a not-for-profit entity, what are supporting

Q36: Describe how the Public Company Accounting Oversight

Q46: Alpha, Inc., a U.S. company, had a

Q54: Coyote Corp. (a U.S. company in Texas)

Q61: Historically, what pattern of reporting was used

Q62: On March 1, 2021, Mattie Company received

Q64: Which of the following is usually not