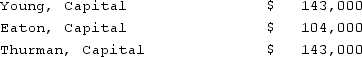

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Thurman's Capital account at the end of the second year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Thurman's Capital account at the end of the second year?

Definitions:

Space Cost

Expenses related to the physical space required for operations, such as warehousing or retail locations.

Handling Cost

The expenses involved in moving, storing, and managing goods, including labor, materials, and overhead.

Storage Costs

Expenses incurred to keep inventory stored safely and effectively, including warehousing, material handling, and preservation costs.

Quantity

Quantity refers to the amount or number of units of a particular item or substance, indicating the volume, size, or extent of that item.

Q7: The Town of Portsmouth has at the

Q9: Teapot, Ltd. is a foreign company that

Q20: The Henry, Isaac, and Jacobs partnership was

Q28: Coyote Corp. (a U.S. company in Texas)

Q41: Under modified accrual accounting, revenues should be

Q42: A net asset balance sheet exposure exists

Q53: Norr and Caylor established a partnership on

Q59: What are the two proprietary fund types?<br>(1)

Q213: Technology is defined as<br>A) the process of

Q370: If a straight line passes through the