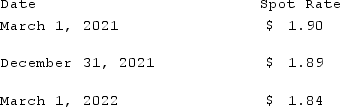

On March 1, 2021, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2022. On March 1, 2021, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2022 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2021. The following spot exchange rates apply:  Mattie's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to foreign exchange risk?

Mattie's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to foreign exchange risk?

Definitions:

Behaviorism

A theory in psychology that emphasizes the importance of observable behaviors over internal phenomena like emotions and thoughts.

Ideal Self

A person's conception of how they would like to be, embodying their goals, aspirations, and values.

Self-concept

An individual's understanding and evaluation of their own personality, competencies, and characteristics, shaping how they see themselves.

Actual Self

is an individual's perception of the self as it is, contrasted with the ideal self or the self that one believes others see.

Q10: Goodman, Pinkman, and White formed a partnership

Q13: The partners of Apple, Bere, and Carroll

Q25: Thompson Corp. was engaged solely in manufacturing

Q26: Goodman, Pinkman, and White formed a partnership

Q29: Ryan Company purchased 80% of Chase Company

Q35: What are the responsibilities of the SEC's

Q83: The Charlton Co. had three operating segments

Q88: Gregor Inc. uses the LIFO cost-flow assumption

Q89: Where is the remeasurement gain or loss

Q112: The accounting problems encountered in consolidated intra-entity