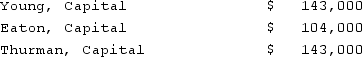

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Young's total share of net income for the second year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Young's total share of net income for the second year?

Definitions:

Explanations

The process of making something clear or understandable, often involving the provision of reasons, causes, or justifications.

Effectiveness

The degree to which something is successful in producing a desired result or outcome; in a second definition, the capability of producing the intended result or achievement of objectives.

Persuade

To convince someone to do or believe something through reasoning or argument.

Q1: Which statement is not correct?<br>A) Governmental funds

Q13: Prior to ASU 2016-14, what are the

Q19: What is a safe cash payment?

Q26: The executor of the Estate of Kate

Q32: On December 31, 2020, the City of

Q38: Carpenter, Inc., a wholly owned subsidiary of

Q52: Hardin, Sutton, and Williams have operated a

Q63: The dissolution of a partnership occurs<br>A) only

Q143: Very few businesses, and virtually no nonprofit

Q338: What is the difference between accounting profit