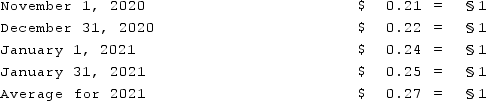

A subsidiary of Dunder Inc., a U.S. company, was located in a foreign country. The functional currency of this subsidiary was the Stickle (§) which is the local currency where the subsidiary is located. The subsidiary acquired inventory on credit on November 1, 2020, for §160,000 that was sold on January 17, 2021 for §207,000. The subsidiary paid for the inventory on January 31, 2021. Currency exchange rates between the dollar and the Stickle were as follows:  What amount would have been reported for cost of goods sold on Dunder's consolidated income statement at December 31, 2021?

What amount would have been reported for cost of goods sold on Dunder's consolidated income statement at December 31, 2021?

Definitions:

Excavate

To remove earth carefully and systematically from an archaeological site to uncover past artifacts or structures.

Pellicle

A flexible outer covering consisting of protein; characteristic of certain protists (e.g., ciliates and euglenoids).

Coralline

Referring to a type of algae that secretes calcium carbonate, contributing to the building of coral reefs.

Coral Reefs

Underwater ecosystems characterized by reef-building corals, which are colonies of tiny living animals found in marine waters containing few nutrients.

Q8: Which of the following is a type

Q23: What happens when a U.S. company purchases

Q23: Ryan Company purchased 80% of Chase Company

Q32: Beagle Co. owned 80% of Maroon Corp.

Q60: Which one of the following statements is

Q67: Dancey, Reese, Newman, and Jahn were partners

Q70: Pear, Inc. owns 80% of Apple Corporation.

Q76: Goodman, Pinkman, and White formed a partnership

Q90: Which of the following statements is true

Q93: Provo, Inc. has an estimated annual tax