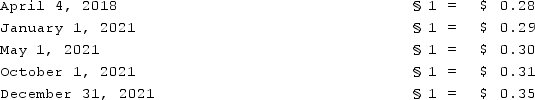

Boerkian Co. started 2021 with two assets: Cash of §26,000 (Stickles) and Land that originally cost §72,000 when acquired on April 4, 2018. On May 1, 2021, the company rendered services to a customer for §36,000, an amount immediately paid in cash. On October 1, 2021, the company incurred an operating expense of §22,000 that was immediately paid. No other transactions occurred during the year so an average exchange rate is not necessary. Currency exchange rates were as follows:  Assume that Boerkian was a foreign subsidiary of a U.S. multinational company and the stickle (§) was the functional currency of the subsidiary. Calculate the translation adjustment for this subsidiary for 2021 and state whether this is a positive or a negative adjustment.

Assume that Boerkian was a foreign subsidiary of a U.S. multinational company and the stickle (§) was the functional currency of the subsidiary. Calculate the translation adjustment for this subsidiary for 2021 and state whether this is a positive or a negative adjustment.

Definitions:

Q12: Teapot, Ltd. is a foreign company that

Q16: What is a company's functional currency?<br>A) The

Q19: On January 1, 2021, a subsidiary buys

Q57: Kennedy Company acquired all of the outstanding

Q59: Quadros Inc., a Portuguese firm was acquired

Q78: Thomas Inc. had the following stockholders' equity

Q78: Curtis purchased inventory on December 1, 2020.

Q82: MacDonald, Inc. owns 80% of the outstanding

Q102: Ryan Company purchased 80% of Chase Company

Q113: How should seasonal revenues be reported in