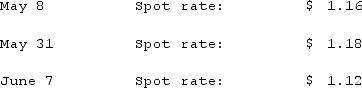

Clark Stone purchases raw material from its foreign supplier, Rinne Clay, on May 8. Payment of 1,500,000 foreign currency units (FC) is due in 30 days. May 31 is Clark's fiscal year-end. The pertinent exchange rates were as follows:  How much Foreign Exchange Gain or Loss should Clark record on May 31?

How much Foreign Exchange Gain or Loss should Clark record on May 31?

Definitions:

Operating Leverage

A measure of how sensitive net operating income is to a given percentage change in dollar sales.

Net Income

The total profit of a company after all expenses and taxes have been subtracted from total revenue.

Contribution Margin

The difference between sales revenue and variable costs, indicating the contribution of sales to fixed costs and profits.

Sales Increase

A rise in the volume or amount of products or services sold by a business.

Q2: The partnership of Clapton, Seidel, and Thomas

Q22: Alpha Corp., about to be liquidated, has

Q23: Ryan Company purchased 80% of Chase Company

Q25: What are the two separate transactions that

Q34: Which one of the following regulates the

Q45: During a partnership liquidation, how are gains

Q52: Flax Co. acquired 80% percent of the

Q72: Mohan owned all of Beatty Inc. Although

Q104: On May 1, 2021, Mosby Company received

Q118: Which of the following statements regarding consolidation