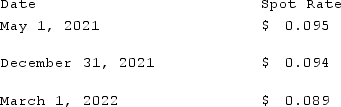

On May 1, 2021, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2022. On May 1, 2021, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2022 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2021. The following spot exchange rates apply:  Mosby's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the overall result of having entered into this hedge of exposure to foreign exchange risk?

Mosby's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the overall result of having entered into this hedge of exposure to foreign exchange risk?

Definitions:

Q3: Why was the Public Utility Holding Company

Q17: Coyote Corp. (a U.S. company in Texas)

Q25: Chase Company owns 80% of Lawrence Company

Q42: Gamma Co. owns 80% of Delta Corp.,

Q45: A foreign subsidiary of a U.S.-based company

Q48: P, L, and O are partners with

Q50: Webb Company purchased 90% of Jones Company

Q76: Hampton Company is trying to decide whether

Q91: Jipsom and Klark were partners with capital

Q102: Which of the following is not a