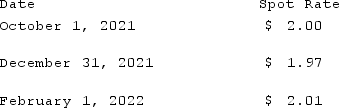

On October 1, 2021, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2022, at a price of 100,000 British pounds. On October 1, 2021, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2021, the option has a fair value of $1,600. The following spot exchange rates apply:  What is the amount of Cost of Goods Sold for 2022 as a result of these transactions?

What is the amount of Cost of Goods Sold for 2022 as a result of these transactions?

Definitions:

Agent's Liability

The legal responsibility an agent may have for their actions or omissions in the course of their agency relationship.

Falsehood

A statement that is untrue, misleading, or inaccurate.

Agency Relationship

A legal connection between two parties where one, the agent, is authorized to act on behalf of the other, the principal, in dealings with third parties.

Pedestrian

An individual who travels on foot, especially in areas designated for walking.

Q1: Schilling, Inc. has three operating segments with

Q3: The statement of financial affairs should be

Q17: Quadros Inc., a Portuguese firm was acquired

Q24: Florrick Co. owns 85% of Bishop Inc.

Q48: A wraparound filing:<br>A) May be used by

Q54: Which of the following statements is true

Q64: Schilling, Inc. has three operating segments with

Q79: When preparing a consolidated statement of cash

Q81: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7395/.jpg" alt=" Patton's operating income

Q104: On May 1, 2021, Mosby Company received