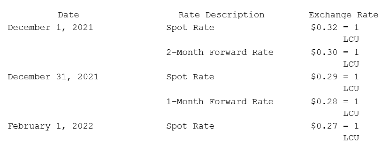

On October 1, 2021, Jarvis Co. sold inventory to a customer in a foreign country, denominated in 100,000 local currency units (LCU). Collection is expected in four months. On October 1, 2021, a forward exchange contract was acquired whereby Jarvis Co. was to pay 100,000 LCU in four months (on February 1, 2022) and receive $78,000 in U.S. dollars. The spot and forward rates for the LCU were as follows:  The company's borrowing rate is 12%. The present value factor for one month is 0.9901.Any discount or premium on the contract is amortized using the straight-line method.Assuming this is a fair value hedge; prepare journal entries for this sales transaction and forward contract.

The company's borrowing rate is 12%. The present value factor for one month is 0.9901.Any discount or premium on the contract is amortized using the straight-line method.Assuming this is a fair value hedge; prepare journal entries for this sales transaction and forward contract.

Definitions:

Cost-Volume-Profit Analysis

An accounting technique used to determine how changes in costs and sales volume affect a company's operating income and net income.

Absorption Costing

An accounting method that includes all manufacturing costs (direct materials, direct labor, and overhead) in the cost of a product.

Common Fixed Costs

Costs that are shared by multiple segments or products of a company and do not change with the volume of production for any single product.

Absorption Costing

Absorption costing is an accounting method where all manufacturing costs (direct materials, direct labor, and both variable and fixed overhead) are included in the cost of a produced unit.

Q11: In translating a foreign subsidiary's financial statements,

Q30: Alpha Corporation owns 100% of Beta Company,

Q35: On January 1, 2021, Youder Inc. bought

Q37: For speculative derivatives, the change in the

Q40: Lawrence Company, a U.S. company, ordered parts

Q45: What is meant by a "partially secured

Q48: Delta Corporation owns 90% of Sigma Company,

Q85: Prepare a Statement of Financial Affairs.

Q109: On January 1, 2021, Bast Co. had

Q118: Which of the following statements regarding consolidation