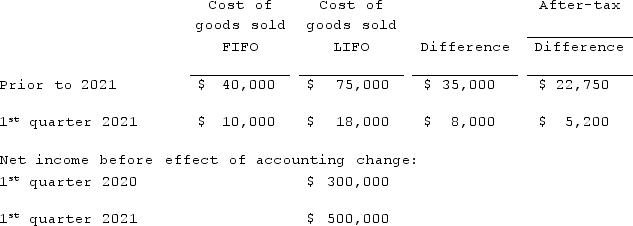

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2021. Baker has an effective income tax rate of 35% and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2021, how much is reported as net income for the first quarter of 2021?

Assuming Baker makes the change in the first quarter of 2021, how much is reported as net income for the first quarter of 2021?

Definitions:

Endorsement

A signature or statement of support for a person, product, or service, often used in the context of financial instruments to transfer rights to another party.

Transferee

The party to whom rights, titles, or interests are transferred or assigned from another party.

Receiving

The process of accepting delivery of goods, verifying them against purchase orders, and formally acknowledging possession.

Cashier's Check

A check issued by a bank, drawn on its own funds rather than that of a personal account, ensuring the availability of funds.

Q6: What are some examples of accounting treatments

Q7: Hank Co. is preparing to issue stock.

Q18: A foreign subsidiary uses the first-in first-out

Q35: What are the responsibilities of the SEC's

Q64: The following information has been taken from

Q79: Strickland Company sells inventory to its parent,

Q92: Certain balance sheet accounts of a foreign

Q99: Faru Co. identified five industry segments: (1)

Q111: Anderson Company, a 90% owned subsidiary of

Q120: Harrison Company, Inc. began operations on January