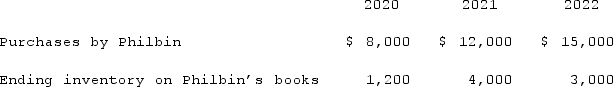

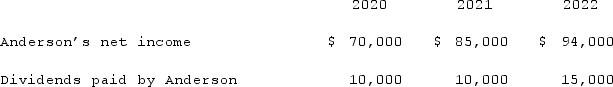

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.  For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2022 consolidation worksheet entry with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2021 intra-entity transfer of merchandise?

For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2022 consolidation worksheet entry with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2021 intra-entity transfer of merchandise?

Definitions:

Ostracism

The exclusion from a society or group.

Autonomy

the capacity and right of individuals to make their own choices and decisions independently.

Achievement Motivation

A drive within individuals that propels them to pursue and attain their goals.

Autonomy

The capacity to make an informed, uncoerced decision; often discussed in psychology, philosophy, and ethics as a critical aspect of human dignity and independence.

Q2: Hambly Corp. owned 80% of the voting

Q12: Following are selected accounts for Green Corporation

Q26: Which of the following statements is true

Q54: Wilkins Inc. owned 60% of Motumbo Co.

Q58: Scott Co. paid $2,800,000 to acquire all

Q71: On January 1, 2021, the Moody Company

Q82: Florrick Co. owns 85% of Bishop Inc.

Q82: Anderson, Inc. acquires all of the voting

Q117: Harrison Company, Inc. began operations on January

Q121: On January 4, 2021, Mason Co. purchased