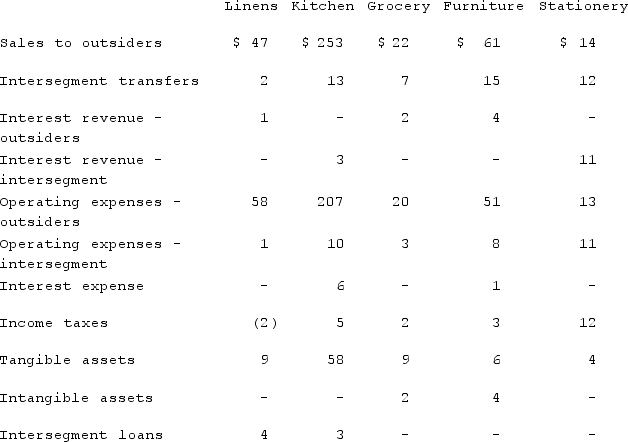

Blanton Corporation is comprised of five operating segments. Information about each of these segments is as follows (in thousands):  Required:

Required:

A) Which operating segments are reportable under the revenue test?

B) What is the total amount of revenues in applying the revenue test?

C) Which operating segments are reportable under the profit or loss test?

D) In applying the profit or loss test, what is the minimum amount an operating segment must have in order to meet the profit or loss test for a reportable segment?

E) Which operating segments are reportable under the asset test?

F) In applying the asset test, what is the minimum amount an operating segment must have in order to meet the asset test for a reportable segment?

G) Which operating segments are reportable?

H) According to the test results for reportable segments, is there a sufficient number of reported segments or should any additional segments also be disclosed? Explain the reason for your conclusion.

Definitions:

Profit Based Compensation

A remuneration strategy where employees' or executives' earnings are directly linked to the profitability of the organization.

Sales Agent

is an individual or company authorized to sell products or services on behalf of a manufacturer or service provider.

Commission

A fee paid to an agent or employee for transacting a piece of business or performing a service, often a percentage of the sale price.

Sales Neutral

refers to a situation where the number of units sold does not significantly impact the financial metrics or strategy of a business.

Q6: What are some examples of accounting treatments

Q13: Quadros Inc., a Portuguese firm was acquired

Q21: Pepe, Incorporated acquired 60% of Devin Company

Q35: Mount Inc. was a hardware store that

Q41: In a tax-free business combination,<br>A) The income

Q61: When a subsidiary is acquired sometime after

Q62: Panton, Inc. acquired 18,000 shares of Glotfelty

Q100: A U.S. company buys merchandise from a

Q111: Anderson Company, a 90% owned subsidiary of

Q121: Delta Corporation owns 90% of Sigma Company,