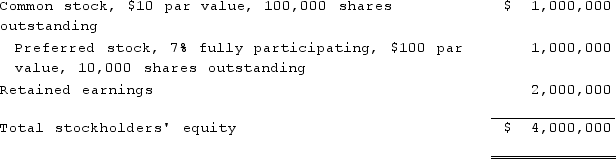

On January 1, 2021, Harrison Corporation spent $2,600,000 to acquire control over Involved, Inc. This price was based on paying $750,000 for 30% of Involved's preferred stock, and $1,850,000 for 80% of its outstanding common stock. As of the date of the acquisition, Involved's stockholders' equity accounts were as follows:  Assuming Involved's accounts are correctly valued within the company's financial statements, what amount of goodwill should be recognized for the Investment in Involved?

Assuming Involved's accounts are correctly valued within the company's financial statements, what amount of goodwill should be recognized for the Investment in Involved?

Definitions:

Factory Payroll

The total compensation paid to employees working within a manufacturing setting, including wages, salaries, and benefits.

Direct Labor

The wages and related costs of employees who are directly involved in the production of goods or services.

Direct Materials Cost

The cost of raw materials that can be directly traced to the production of goods, excluding indirect materials like maintenance supplies.

Finished Goods Inventory

Finished products awaiting sale but still not purchased.

Q1: Wilkins Inc. acquired 100% of the voting

Q8: Woof Co. acquired all of Meow Co.

Q35: For an acquisition when the subsidiary retains

Q37: In a father-son-grandson combination, which of the

Q46: D Corp. had investments, direct and indirect,

Q61: Thomas Inc. had the following stockholders' equity

Q95: A company had common stock with a

Q99: What is the basic assumption underlying the

Q107: What are the benefits or advantages of

Q111: Anderson Company, a 90% owned subsidiary of