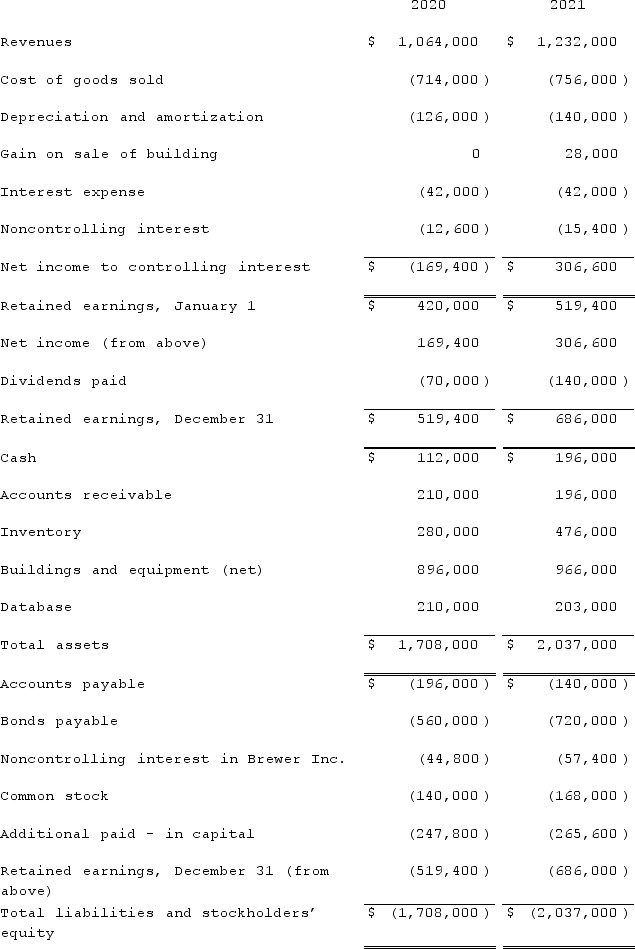

Allen Co. held 80% of the common stock of Brewer Inc. and 40% of this subsidiary's convertible bonds. The following consolidated financial statements were for 2020 and 2021.  Additional Information:Bonds were issued during 2021 by the parent for cash.Amortization of a database acquired in the original combination amounted to $7,000 per year.A building with a cost of $84,000 but a $42,000 book value was sold by the parent for cash on May 11, 2021.Equipment was purchased by the subsidiary on July 23, 2021, using cash.Late in November 2021, the parent issued common stock for cash.During 2021, the subsidiary paid dividends of $14,000.Required:Prepare a consolidated statement of cash flows for this business combination for the year ending December 31, 2021. Either the direct method or the indirect method may be used.

Additional Information:Bonds were issued during 2021 by the parent for cash.Amortization of a database acquired in the original combination amounted to $7,000 per year.A building with a cost of $84,000 but a $42,000 book value was sold by the parent for cash on May 11, 2021.Equipment was purchased by the subsidiary on July 23, 2021, using cash.Late in November 2021, the parent issued common stock for cash.During 2021, the subsidiary paid dividends of $14,000.Required:Prepare a consolidated statement of cash flows for this business combination for the year ending December 31, 2021. Either the direct method or the indirect method may be used.

Definitions:

Annual Dividend

The total sum of the dividends paid to shareholders over a year, often cited per share.

Rates of Return

Financial results such as gains or losses on an investment over a predetermined time frame, expressed as a percentage of the original investment fee.

Net Cash Flows

The amount of cash that is generated or lost by a business in a given time period, calculated as cash inflows minus cash outflows.

Rate of Return

The returns or deficits generated by an investment over a certain span, represented as a percentage of the initial financial commitment.

Q2: Watkins, Inc. acquires all of the outstanding

Q4: Panton, Inc. acquired 18,000 shares of Glotfelty

Q9: Salem Co. had the following account balances

Q13: McGuire Company acquired 90 percent of Hogan

Q17: Coyote Corp. (a U.S. company in Texas)

Q39: Pell Company acquires 80% of Demers Company

Q48: Delta Corporation owns 90% of Sigma Company,

Q91: How does the accounting for intra-entity dividends

Q109: Presented below are the financial balances for

Q115: On January 1, 2021, the Moody Company