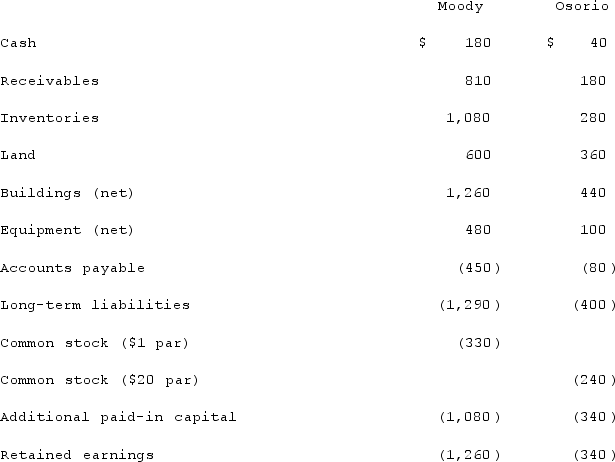

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated additional paid-in capital at date of acquisition.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated additional paid-in capital at date of acquisition.

Definitions:

Teenage Pregnancies

Refers to pregnancies occurring in individuals who are in their teenage years, often bringing unique social, economic, and health challenges.

Unwed Motherhood

The state of a woman giving birth without being married, which may involve various social, legal, and economic implications.

Comprehensive Sex Education

An educational approach that provides thorough and unbiased information on sexual health, relationships, and decision making.

Intrusive

Describes actions or behaviors that infringe upon someone's privacy or personal space without consent.

Q22: How should an investor account for, and

Q25: Media sharing sites allow users to decide

Q38: Riya saw a box of collector's edition

Q44: Vaughn Inc. acquired all of the outstanding

Q51: Walsh Company sells inventory to its subsidiary,

Q58: On January 1, 2019, Palk Corp. and

Q59: The financial statement amounts for the Atwood

Q62: On January 1, 2021, Lee Company paid

Q67: Anderson Company, a 90% owned subsidiary of

Q70: Following are selected accounts for Green Corporation