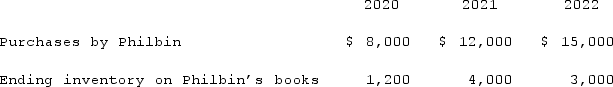

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

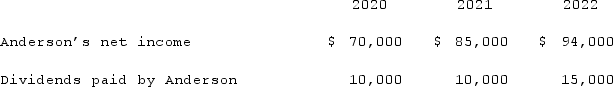

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.  Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of Anderson for 2020.

Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of Anderson for 2020.

Definitions:

Sustainability

The practice of meeting current needs without compromising the ability of future generations to meet theirs, emphasizing environmental, social, and economic balance.

Organizational Structure

The way in which a company is organized, including its hierarchy, departmentalization, and distribution of roles.

Sales Response Function

A model that illustrates the relationship between sales and marketing efforts, demonstrating how changes in marketing strategies affect sales.

Vertical (Y) Axis

The axis in a coordinate plane that typically represents the dependent variable in a graph, running perpendicular to the horizontal (X) axis.

Q16: On January 3, 2021, Roberts Company purchased

Q18: On January 3, 2021, Madison Corp. purchased

Q25: What are the two separate transactions that

Q29: Ryan Company purchased 80% of Chase Company

Q45: Parker Corp., a U.S. company, had the

Q61: Strickland Company sells inventory to its parent,

Q70: What is meant by the terms direct

Q80: Walsh Company sells inventory to its subsidiary,

Q111: For acquisition accounting, why are assets and

Q122: Walsh Company sells inventory to its subsidiary,