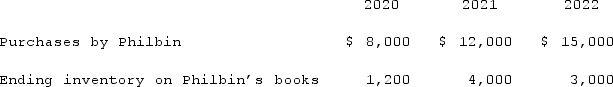

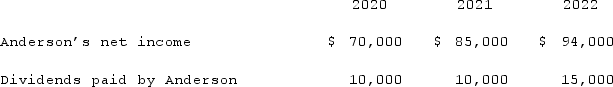

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.  For consolidation purposes, what amount would be debited to cost of goods sold for the 2021 consolidation worksheet with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2021 transfer of merchandise?

For consolidation purposes, what amount would be debited to cost of goods sold for the 2021 consolidation worksheet with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2021 transfer of merchandise?

Definitions:

Parallel Construction

The use of the same pattern of words to show that two or more ideas have the same level of importance.

Similar Structures

Architectural or organizational elements that share comparable features or organization.

Simple Sentence

A sentence structure consisting of a single independent clause that has a subject and a predicate.

Monthly Premiums

Regular payments made to maintain an insurance policy or other subscription-based service.

Q14: Fesler Inc. acquired all of the outstanding

Q26: How is the fair value allocation of

Q34: Kurton Inc. owned 90% of Luvyn Corp.'s

Q46: Daniels Inc. acquired 85% of the outstanding

Q48: Popper Co. acquired 80% of the common

Q57: On March 1, 2021, Mattie Company received

Q84: Under the equity method of accounting for

Q107: How does a parent company account for

Q122: Walsh Company sells inventory to its subsidiary,

Q122: Borgin Inc. owns 30% of the outstanding