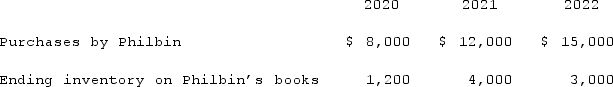

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

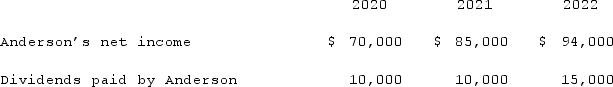

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.  Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of Anderson for 2021.

Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of Anderson for 2021.

Definitions:

Employer's Health Plan

A health insurance plan provided by an employer to its employees as part of employment benefits, covering medical expenses and care.

Socially Isolated

The condition of being separated from others, not participating in social activities, or lacking a sense of belonging with others.

Community Psychiatric Nurse

A specialized nurse who provides mental health services to patients in community settings, focusing on rehabilitation and support.

Daily Food Allowance

Recommended nutrient intakes for a day to maintain good health.

Q24: Thomas Inc. had the following stockholders' equity

Q28: Coyote Corp. (a U.S. company in Texas)

Q46: Stark Company, a 90% owned subsidiary of

Q71: On January 1, 2021, the Moody Company

Q74: Milton Co. owned all of the voting

Q81: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7395/.jpg" alt=" Patton's operating income

Q99: Faru Co. identified five industry segments: (1)

Q100: Buckette Co. owned 60% of Shuvelle Corp.

Q106: Dog Corporation acquires all of Cat, Inc.

Q116: In measuring the noncontrolling interest immediately following