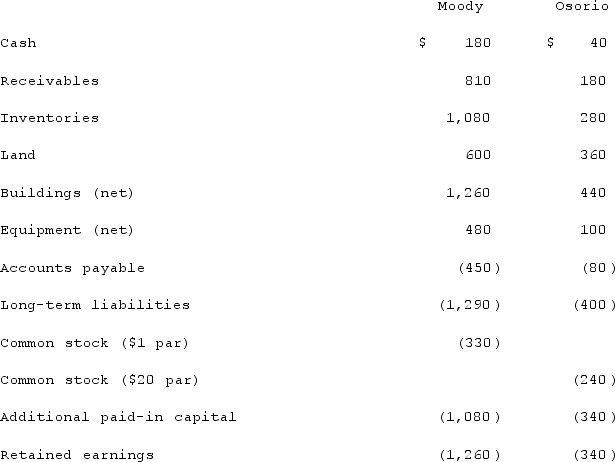

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated common stock at date of acquisition.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated common stock at date of acquisition.

Definitions:

Independent

Not influenced or controlled by others; in statistics, it refers to variables that are not related to each other.

Standard Deviations

A measure that quantifies the amount of variation or dispersion of a set of data values from the mean.

Soccer Team

A group of players, typically eleven, who participate together in the sport of soccer, competing in matches against other teams.

Random Variable

An unpredictable phenomenon's numerical outcome represented as a variable.

Q9: Explain the role of social media in

Q14: Which of the following measures one customer's

Q16: As long as the ads are not

Q40: The assertion,"price is that which is given

Q55: Town Co. appropriately uses the equity method

Q61: Websites that allow consumers to post,read,rate,and comment

Q65: McCoy has the following account balances as

Q69: Which of the following is a price

Q82: Anderson, Inc. acquires all of the voting

Q106: When consolidating a subsidiary that was acquired