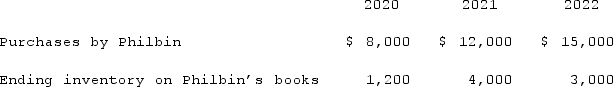

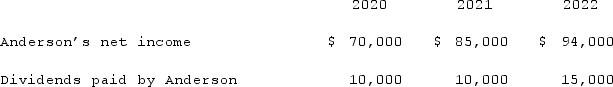

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.  For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2022 consolidation worksheet entry with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2021 intra-entity transfer of merchandise?

For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2022 consolidation worksheet entry with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2021 intra-entity transfer of merchandise?

Definitions:

Convertible Bonds

Financial instruments that can be converted into a specified number of common stock shares at the discretion of the bondholder, usually at certain times during their life.

Control

The power to influence or direct people's behavior or the course of events.

Warrants

Financial instruments allowing the holder to choose to purchase or sell an asset at a predetermined price prior to a specified deadline, without being required to do so.

Call Options

Financial derivatives that give the holder the right, but not the obligation, to buy an asset at a specified price within a specific time frame.

Q3: Baker Corporation changed from the LIFO method

Q3: On January 1, 2020, Barber Corp. paid

Q34: Pell Company acquires 80% of Demers Company

Q80: Pell Company acquires 80% of Demers Company

Q81: Which of the following statements is true

Q90: Presented below are the financial balances for

Q92: The financial statement amounts for the Atwood

Q92: On December 1, 2021, Keenan Company, a

Q104: On May 1, 2021, Mosby Company received

Q120: McLaughlin, Inc. acquires 70% of Ellis Corporation