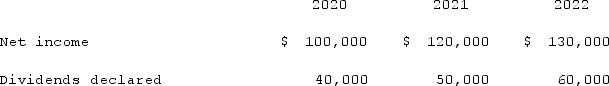

Wilson owned equipment with an estimated life of 10 years when the equipment was acquired for an original cost of $80,000. The equipment had a book value of $50,000 at January 1, 2020. On January 1, 2020, Wilson realized that the useful life of the equipment was longer than originally anticipated, at ten remaining years.On April 1, 2020 Simon Company, a 90% owned subsidiary of Wilson Company, bought the equipment from Wilson for $68,250 and for depreciation purposes used the estimated remaining life as of that date. The following data are available pertaining to Simon's income and dividends declared:  Compute the amortization of gain through a depreciation adjustment for 2022 for consolidation purposes.

Compute the amortization of gain through a depreciation adjustment for 2022 for consolidation purposes.

Definitions:

BMW Brand

A prestigious automobile brand known for its performance, luxury vehicles, and innovative automotive technology.

Short Films

Brief cinematic works, typically lower in length than feature films, used to convey a story or message in a condensed format.

Psychological Factors

Elements that impact consumer behavior and decision-making, including attitudes, perceptions, and motivations.

Purchase Decisions

The process by which consumers decide what, when, and how to buy a product or service.

Q22: Jaynes Inc. acquired all of Aaron Co.'s

Q31: In a transaction accounted for using the

Q32: On January 1, 2021, Nichols Company acquired

Q36: In a situation where the investor exercises

Q55: Where do dividends paid by a subsidiary

Q61: Which of the following is true concerning

Q65: On January 1, 2019, Glenville Co. acquired

Q73: On January 4, 2021, Snow Co. purchased

Q74: McGuire Company acquired 90 percent of Hogan

Q108: On January 1, 2020, Archer, Incorporated, paid