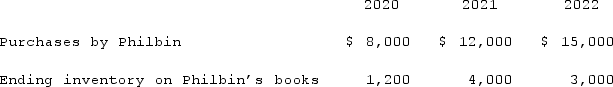

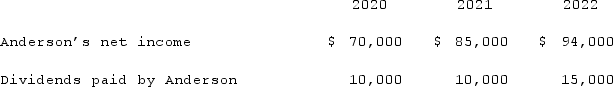

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.  For consolidation purposes, what amount would be debited to cost of goods sold for the 2020 consolidation worksheet with regard to unrecognized intra-entity gross profit remaining in ending inventory with respect to the transfer of merchandise?

For consolidation purposes, what amount would be debited to cost of goods sold for the 2020 consolidation worksheet with regard to unrecognized intra-entity gross profit remaining in ending inventory with respect to the transfer of merchandise?

Definitions:

Opinion

A belief or judgment formed about something, not necessarily based on fact or knowledge.

Corporate Social Responsibility

A business model that helps a company be socially accountable—to itself, its stakeholders, and the public; it involves practicing good citizenship through sustainable business operations and philanthropy.

Sarbanes-Oxley Act

U.S. legislation enacted in 2002 to protect investors from fraudulent financial reporting by corporations, requiring strict adherence to accounting standards and the establishment of internal controls.

Internal Control

Internal control encompasses the policies and procedures implemented by a business to safeguard its assets, ensure accurate financial reporting, promote accountability, and prevent fraud.

Q28: On January 1, 2021, A. Hamilton, Inc.

Q32: Beagle Co. owned 80% of Maroon Corp.

Q37: Jackson Company acquires 100% of the stock

Q46: Stark Company, a 90% owned subsidiary of

Q58: Scott Co. paid $2,800,000 to acquire all

Q62: On March 1, 2021, Mattie Company received

Q83: Explain how the treasury stock approach treats

Q83: Stark Company, a 90% owned subsidiary of

Q94: On January 1, 2019, Jannison Inc. acquired

Q105: On January 4, 2021, Mason Co. purchased