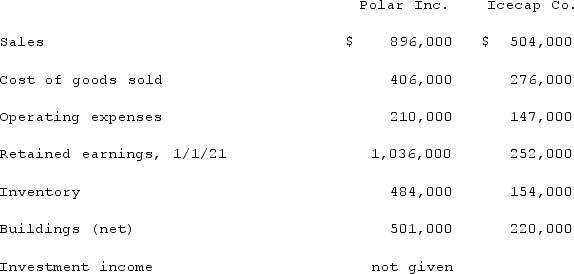

Several years ago, Polar Inc. acquired an 80% interest in Icecap Co. The book values of Icecap's asset and liability accounts at that time were considered to be equal to their fair values. Polar's acquisition value corresponded to the underlying book value of Icecap so that no allocations or goodwill resulted from the transfer.The following selected account balances were from the individual financial records of these two companies as of December 31, 2021:  Assume that Polar sold inventory to Icecap at a markup equal to 25% of cost. Intra-entity transfers were $130,000 in 2020 and $165,000 in 2021. Of this inventory, $39,000 of the 2020 transfers were retained and then sold by Icecap in 2021, while $55,000 of the 2021 transfers were held until 2022.Required:For the consolidated financial statements for 2021, determine the balances that would appear for the following accounts: (i) Cost of Goods Sold; (ii) Inventory; and (iii) Net income attributable to the noncontrolling interest.

Assume that Polar sold inventory to Icecap at a markup equal to 25% of cost. Intra-entity transfers were $130,000 in 2020 and $165,000 in 2021. Of this inventory, $39,000 of the 2020 transfers were retained and then sold by Icecap in 2021, while $55,000 of the 2021 transfers were held until 2022.Required:For the consolidated financial statements for 2021, determine the balances that would appear for the following accounts: (i) Cost of Goods Sold; (ii) Inventory; and (iii) Net income attributable to the noncontrolling interest.

Definitions:

Administrative Procedure Act

Legislation governing the process by which federal administrative agencies propose and establish regulations.

Statute

A formal written law enacted by a legislative body; statutes govern areas not covered by common law.

FOIA

stands for the Freedom of Information Act, a U.S. law that grants the public the right to request access to records from any federal agency, promoting transparency in government.

Federal Agencies

Government bodies established by the United States Congress to implement and administer specific federal laws and policies.

Q3: On December 1, 2021, King Co. sold

Q33: How is the amortization of goodwill treated

Q33: When a parent company acquires a less-than-100

Q54: On January 1, 2020, Hemingway Co. acquired

Q55: Town Co. appropriately uses the equity method

Q60: Dean Hardware, Inc. is comprised of five

Q82: Pot Co. holds 90% of the common

Q84: A variable interest entity can take all

Q85: Watkins, Inc. acquires all of the outstanding

Q124: Florrick Co. owns 85% of Bishop Inc.