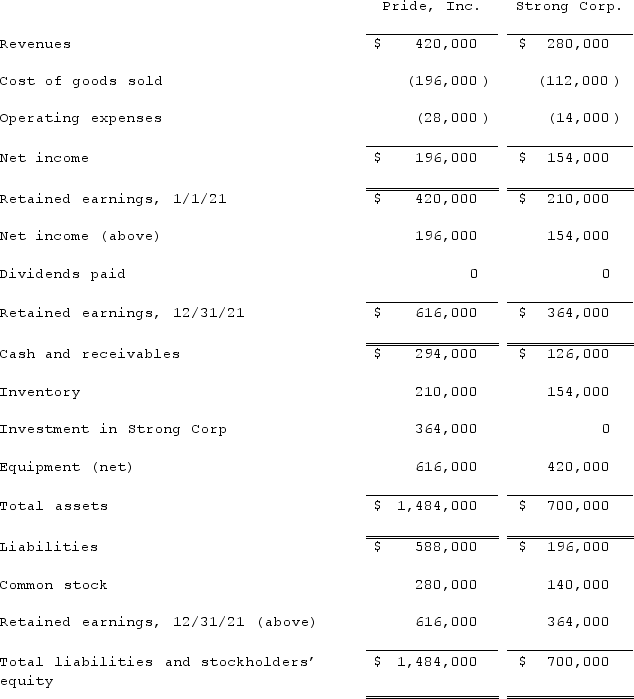

On January 1, 2021, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill, which has not been impaired.As of December 31, 2021, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the consolidated total of noncontrolling interest at December 31, 2021?

During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the consolidated total of noncontrolling interest at December 31, 2021?

Definitions:

Francis Townsend

An American physician who was known for his advocacy for the elderly and his proposal of a pension plan to aid the elderly during the Great Depression, leading to the creation of Social Security.

Economic Recovery

The process by which a nation's economy begins to thrive again following a period of decline or recession, marked by increases in employment, consumer spending, and overall economic growth.

Industrial Workers

Employees involved in the manufacturing sector, often in factories, who contribute to the production of goods.

Q21: On January 1, 2019, Jannison Inc. acquired

Q28: On January 1, 2021, A. Hamilton, Inc.

Q36: Strickland Company sells inventory to its parent,

Q48: On December 1, 2021, Keenan Company, a

Q60: How does the parent's choice of investment

Q62: On January 1, 2021, Lee Company paid

Q66: The financial statement amounts for the Atwood

Q81: Strickland Company sells inventory to its parent,

Q85: On January 1, 2021, the Moody Company

Q118: Which of the following statements regarding consolidation