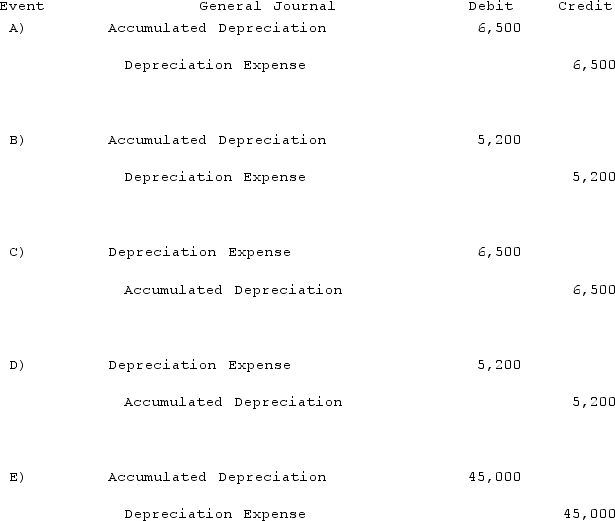

Palmer Corp. owned 80% of the outstanding common stock of Creed Inc. On January 1, 2019, Palmer acquired a building with a ten-year life for $450,000. No salvage value was anticipated and the building was to be depreciated on the straight-line basis. On January 1, 2021, Palmer sold this building to Creed for $412,000. At that time, the building had a remaining life of eight years but still no expected salvage value. For consolidation purposes, what is the Excess Depreciation (ED entry) for this building for 2021?

Definitions:

Amortization

The process of spreading the cost of an intangible asset over its useful life.

Accrued Interest

Accrued Interest is the interest that has accumulated on a loan or bond since the last interest payment was made but has not yet been paid out.

Straight-Line Method

An accounting method of depreciation where a fixed amount is charged annually over the useful life of the asset.

Q25: What are the two separate transactions that

Q28: Coyote Corp. (a U.S. company in Texas)

Q38: Jaynes Inc. acquired all of Aaron Co.'s

Q48: Delta Corporation owns 90% of Sigma Company,

Q64: How is the gain on an intra-entity

Q69: With respect to identifiable intangible assets other

Q69: When Valley Co. acquired 80% of the

Q82: Elektronix, Inc. has three operating segments with

Q97: On January 1, 2021, Harrison Corporation spent

Q117: Pritchett Company recently acquired three businesses, recognizing