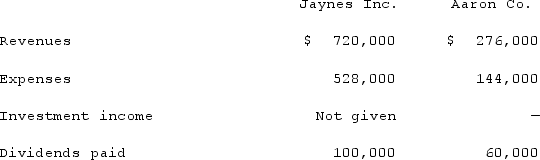

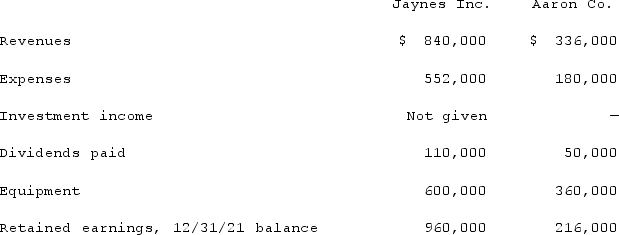

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2020, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities acquired is assigned to an unrecorded patent to be amortized over ten years.The following figures came from the individual accounting records of these two companies as of December 31, 2020:  The following figures came from the individual accounting records of these two companies as of December 31, 2021:

The following figures came from the individual accounting records of these two companies as of December 31, 2021:  What was consolidated net income for the year ended December 31, 2021?

What was consolidated net income for the year ended December 31, 2021?

Definitions:

Refused

When a request, offer, or proposal is not accepted or denied by the receiving party.

Federal Organizational Corporate Sentencing Guidelines

Rules established to determine the sentencing for corporations found guilty of federal offenses, aiming to structure penalties and encourage compliance and ethical conduct.

Reduced Sentencing

Reduced sentencing involves the shortening of a legal penalty or jail time based on various factors such as good behavior or plea bargaining.

Compliance And Ethics

This term refers to the corporate practices that ensure an organization and its employees conform to legal standards and ethical norms in their business operations and decision-making processes.

Q4: Return on investment (ROI)for a firm is<br>A)

Q5: Prater Inc. owned 85% of the voting

Q30: A cash refund given for the purchase

Q33: Lisa Co. paid cash for all of

Q44: As the product enters the maturity stage,prices

Q57: A situation in which consumer response is

Q61: Websites that allow consumers to post,read,rate,and comment

Q91: On January 1, 2021, Doyle Corp. acquired

Q94: What is the impact on the noncontrolling

Q94: Acker Inc. bought 40% of Howell Co.