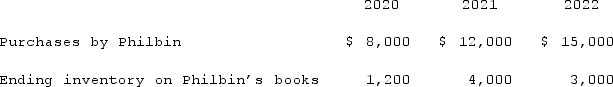

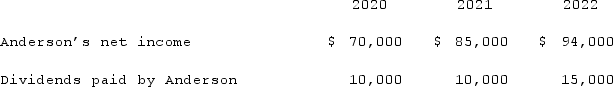

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.  For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2020 consolidation worksheet entry with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2020 intra-entity transfer of merchandise?

For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2020 consolidation worksheet entry with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2020 intra-entity transfer of merchandise?

Definitions:

Work Environment

The setting, conditions, and culture in which an individual performs their job, including physical and social aspects.

Biohazardous Waste Label

A label that identifies containers or bags holding waste contaminated with blood or other infectious materials.

Red Bags

Specially designated bags used in medical and healthcare settings for containing and disposing of biohazardous or infectious waste safely.

Blood Or Body Fluids

Liquids originating from inside the bodies of living organisms, essential for transporting nutrients, oxygen, and waste materials.

Q4: All of the following statements regarding the

Q11: Larson Company, a U.S. company, has an

Q14: Fesler Inc. acquired all of the outstanding

Q32: On January 1, 2021, the Moody Company

Q42: Jackson Company acquires 100% of the stock

Q71: Natarajan, Inc. had the following operating segments,

Q73: On January 4, 2021, Snow Co. purchased

Q81: Strickland Company sells inventory to its parent,

Q92: Parent Corporation acquired some of its subsidiary's

Q97: On January 1, 2021, Harrison Corporation spent