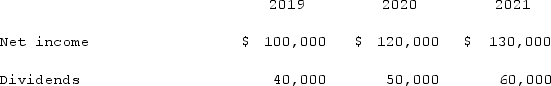

Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2019. Demers reported common stock of $300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000 and buildings were undervalued by $40,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was attributed to goodwill with an indefinite life. Based on an annual review, goodwill has not been impaired.Demers earns income and pays dividends as follows:  Assume the partial equity method is applied.Compute Pell's Investment in Demers at December 31, 2020.

Assume the partial equity method is applied.Compute Pell's Investment in Demers at December 31, 2020.

Definitions:

Industrialization

describes the transformation from societies based predominantly on agriculture to ones based on the manufacturing of goods and services, leading to economic growth and societal change.

Undocumented Workers

Individuals working in a country without legal authorization, often lacking the necessary visas or other documentation.

Immigration Law

Legal statutes, regulations, and precedents governing immigration and the status of immigrants within a country.

Progressive Taxation

A tax system in which the tax rate increases as the taxable amount increases, often designed to distribute the tax burden more evenly across various income levels.

Q14: Stark Company, a 90% owned subsidiary of

Q24: Acker Inc. bought 40% of Howell Co.

Q32: Bassett Inc. acquired all of the outstanding

Q50: Webb Company purchased 90% of Jones Company

Q90: Which of the following statements is true

Q93: Strayten Corp. is a wholly owned subsidiary

Q98: On January 1, 2020, Jones Company bought

Q101: Kurton Inc. owned 90% of Luvyn Corp.'s

Q111: For acquisition accounting, why are assets and

Q118: Jull Corp. owned 80% of Solaver Co.