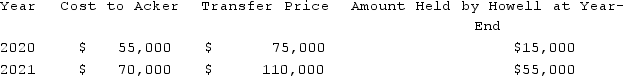

Acker Inc. bought 40% of Howell Co. on January 1, 2020 for $576,000. The equity method of accounting was used. The book value and fair value of the net assets of Howell on that date were $1,440,000. Acker began supplying inventory to Howell as follows:  Howell reported net income of $100,000 in 2020 and $120,000 in 2021 while paying $40,000 in dividends each year.What is the Equity in Howell Income that should be reported by Acker in 2020?

Howell reported net income of $100,000 in 2020 and $120,000 in 2021 while paying $40,000 in dividends each year.What is the Equity in Howell Income that should be reported by Acker in 2020?

Definitions:

Flexible Budgets

Budgets that adjust or vary with changes in volume or activity levels of the business.

Actual Overhead

The real costs incurred by a business for overhead, such as rent, utilities, and administrative expenses, during a specific period.

Budgeted Manufacturing

The process of estimating future production costs, including materials, labor, and overhead, for a specific period.

Manufacturing Overhead

Indirect factory-related costs that are incurred when producing a product, which can include utilities, maintenance, and factory equipment depreciation.

Q3: Which of the following statements is true

Q5: Pell Company acquires 80% of Demers Company

Q18: On January 3, 2021, Madison Corp. purchased

Q27: Which of the following illustrates the correct

Q31: Which theory is based on the premise

Q34: Pell Company acquires 80% of Demers Company

Q38: Jaynes Inc. acquired all of Aaron Co.'s

Q74: Which of the following refers to public

Q83: Noise refers to anything that interferes with,distorts,or

Q95: Jaynes Inc. acquired all of Aaron Co.'s