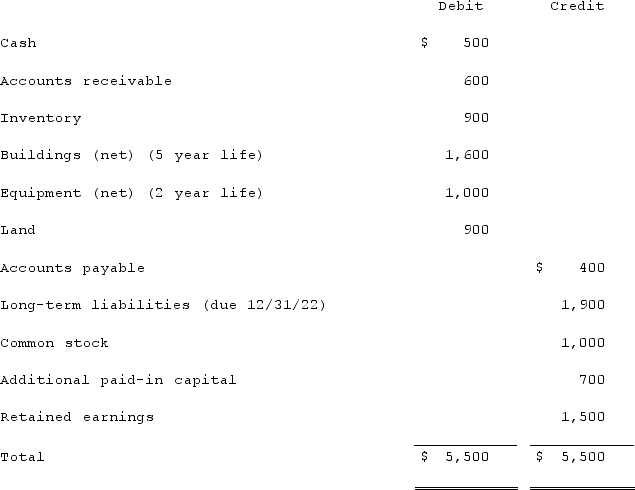

Jackson Company acquires 100% of the stock of Clark Corporation on January 1, 2020, for $4,100 cash. As of that date Clark has the following trial balance:  Net income and dividends reported by Clark for 2020 and 2021 follow:

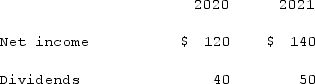

Net income and dividends reported by Clark for 2020 and 2021 follow:  The fair value of Clark's net assets that differ from their book values are listed below:

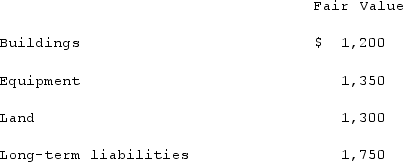

The fair value of Clark's net assets that differ from their book values are listed below:  Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's equipment that would be reported in a December 31, 2020, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's equipment that would be reported in a December 31, 2020, consolidated balance sheet.

Definitions:

Mean IQ Scores

The average score derived from standardized intelligence testing, used as an indicator of relative intelligence across a population.

Mean IQ Score

The average score derived from a set of intelligence quotient (IQ) test results.

Restandardize

The process of revising and updating standards or norms, typically in the context of tests or measurements, to reflect current information or conditions.

Mean Score

A statistical measure that represents the average value of a set of numbers.

Q33: When a parent company acquires a less-than-100

Q44: Cayman Inc. bought 30% of Maya Company

Q79: Goodwill is often acquired as part of

Q82: Pell Company acquires 80% of Demers Company

Q90: Which of the following statements is true

Q92: Several years ago, Polar Inc. acquired an

Q98: On January 1, 2021, the Moody Company

Q99: The practice of charging a very low

Q111: On January 1, 2020, Archer, Incorporated, paid

Q117: How do intra-entity transfers of inventory affect