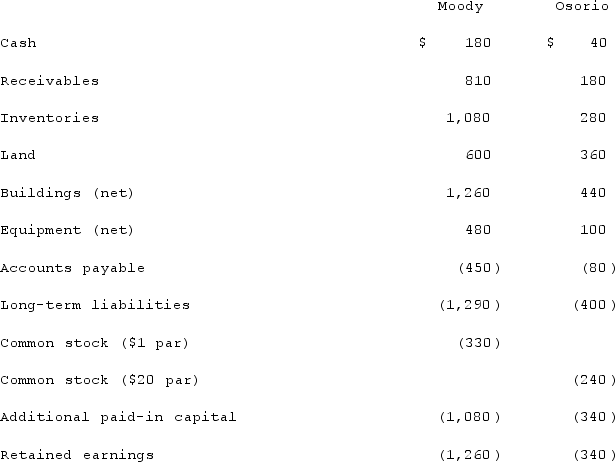

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated equipment at date of acquisition.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated equipment at date of acquisition.

Definitions:

Critical Value

A threshold in hypothesis testing that defines the boundary or cutoff for deciding whether to reject the null hypothesis.

Null Hypothesis

A statistical hypothesis that suggests there is no effect or no difference, and it serves as the default position that there is no association between two measured phenomena.

One-way ANOVA

A statistical method used to compare the means of three or more independent groups to determine if there is a statistically significant difference among them.

F-ratio

The F-ratio is a statistic used in analysis of variance (ANOVA) to compare the variability between groups to the variability within groups, assessing whether group means are significantly different.

Q8: Pell Company acquires 80% of Demers Company

Q22: Which of the following statements are true

Q29: McCoy has the following account balances as

Q36: Strickland Company sells inventory to its parent,

Q48: Farah Corp. purchased 35% of the common

Q54: On January 2, 2021, Barley Corp. purchased

Q57: On January 1, 2020, Elva Corp. paid

Q81: Basing-point pricing is a price tactic that

Q87: Patti Company owns 80% of the common

Q102: Ryan Company purchased 80% of Chase Company