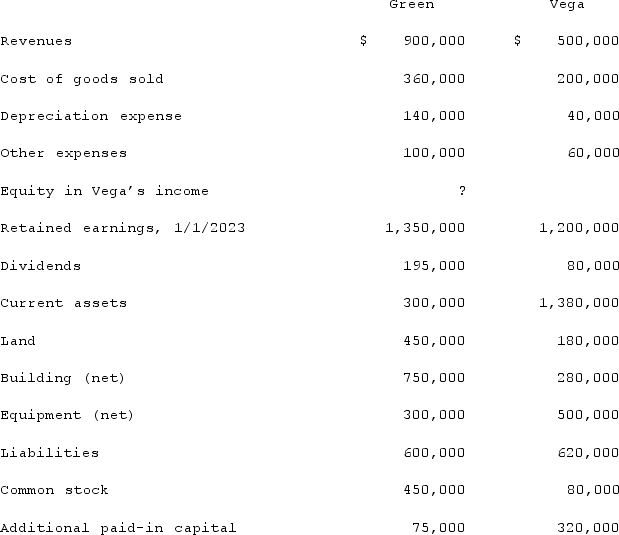

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2023. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated land.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated land.

Definitions:

Rationalization

A defense mechanism where controversial behaviors or feelings are justified and explained in a seemingly rational or logical manner to avoid the true explanation.

Ongoing Treatment

A continuous process of medical or therapeutic care provided to manage or improve a particular health condition.

Last Drink

Refers to the most recent occasion on which an individual consumed an alcoholic beverage, often inquired about in contexts related to alcohol abuse treatment or legal issues around impaired driving.

Alcohol Abuse

Denotes the harmful use of alcohol that negatively impacts a person's health, social, or economic functioning.

Q10: A parent acquires all of a subsidiary's

Q18: On January 1, 2021, Harley Company bought

Q21: Which of the following refers to using

Q23: Ryan Company purchased 80% of Chase Company

Q24: Acker Inc. bought 40% of Howell Co.

Q30: Kaye Company acquired 100% of Fiore Company

Q71: Under the partial equity method, the parent

Q88: Pot Co. holds 90% of the common

Q88: Milan,a marketing manager of a pharmaceutical company,opens

Q101: How would consolidated earnings per share be