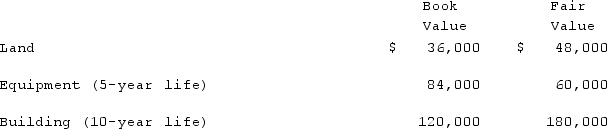

Utah Inc. acquired all of the outstanding common stock of Trimmer Corp. on January 1, 2019. At that date, Trimmer owned only three assets and had no liabilities:  If Utah paid $300,000 in cash for Trimmer, what allocation and amortization should have been assigned to the subsidiary's Building account and its Equipment account in a December 31, 2021 consolidation?

If Utah paid $300,000 in cash for Trimmer, what allocation and amortization should have been assigned to the subsidiary's Building account and its Equipment account in a December 31, 2021 consolidation?

Definitions:

Stock Split

A corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares.

Shareholders' Equity

Shareholders' equity represents the residual interest in the assets of a corporation after deducting its liabilities, indicating the ownership interest of the shareholders.

2-For-1 Stock Split

A corporate action where a company doubles its number of outstanding shares, halving the stock price, effectively giving shareholders two shares for every one they owned.

Cancellation

The act of nullifying or terminating a previously established agreement or contract.

Q1: What argument could be made against the

Q30: A cash refund given for the purchase

Q32: On January 1, 2021, the Moody Company

Q58: The following information has been taken from

Q70: Pell Company acquires 80% of Demers Company

Q83: When a company has preferred stock in

Q92: Renz Co. acquired 80% of the voting

Q94: What pricing policy entails charging a relatively

Q106: A situation in which an increase or

Q111: Jackson Company acquires 100% of the stock