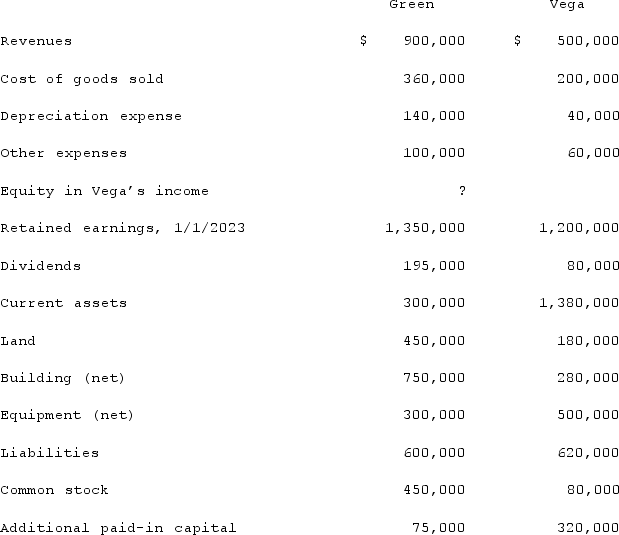

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2023. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated common stock.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated common stock.

Definitions:

Current Margin

The present profit margin; the difference between the sales revenue and the cost of goods sold at the current time.

Desired Margin

The profit margin a company aims for over the cost of a product or service.

Increase Price

The act of raising the cost at which goods or services are sold, usually to reflect higher production costs or to gain greater profit margins.

Own-Price Elasticity

A measure of how much the quantity demanded of a good responds to a change in its own price, with higher elasticity indicating greater sensitivity.

Q36: Hoyt Corporation agreed to the following terms

Q37: The financial statement amounts for the Atwood

Q40: Pell Company acquires 80% of Demers Company

Q47: Pell Company acquires 80% of Demers Company

Q50: What is the primary difference between: (i)

Q50: Horse Corporation acquires all of Pony, Inc.

Q62: The financial statement amounts for the Atwood

Q65: The balance sheets of Butler, Inc. and

Q80: Delta Corporation owns 90% of Sigma Company,

Q122: Scott Co. paid $2,800,000 to acquire all