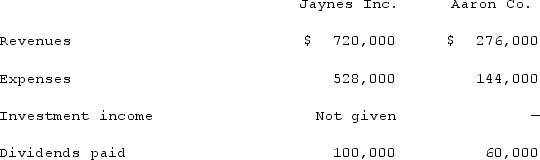

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2020, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities acquired is assigned to an unrecorded patent to be amortized over ten years.The following figures came from the individual accounting records of these two companies as of December 31, 2020:  The following figures came from the individual accounting records of these two companies as of December 31, 2021:

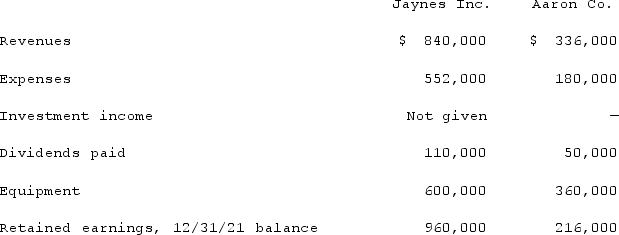

The following figures came from the individual accounting records of these two companies as of December 31, 2021:  What was consolidated equipment as of December 31, 2021?

What was consolidated equipment as of December 31, 2021?

Definitions:

Divorce Rate

A statistical figure expressed as the number of divorces occurring among the population of a given area during a year per 1,000 population.

Serial Monogamy

The practice of engaging in a series of monogamous relationships, where one partnership is followed by another over time.

Marriage

A legally and socially sanctioned union, usually between two individuals, that is regulated by laws, norms, and customs that define rights and duties of the partners.

Social Institutions

Established sets of norms and subsystems that support each society's survival, such as family, education, and government.

Q12: Which of the following processes is used

Q25: Chase Incorporated sold $260,000 of its inventory

Q26: Acker Inc. bought 40% of Howell Co.

Q28: Why is it important to know if

Q30: A cash refund given for the purchase

Q74: Harrison, Inc. acquires 100% of the voting

Q77: Inelastic demand is a situation in which<br>A)

Q112: Which of the following statements best defines

Q121: The financial statement amounts for the Atwood

Q130: A price tactic that requires the buyer