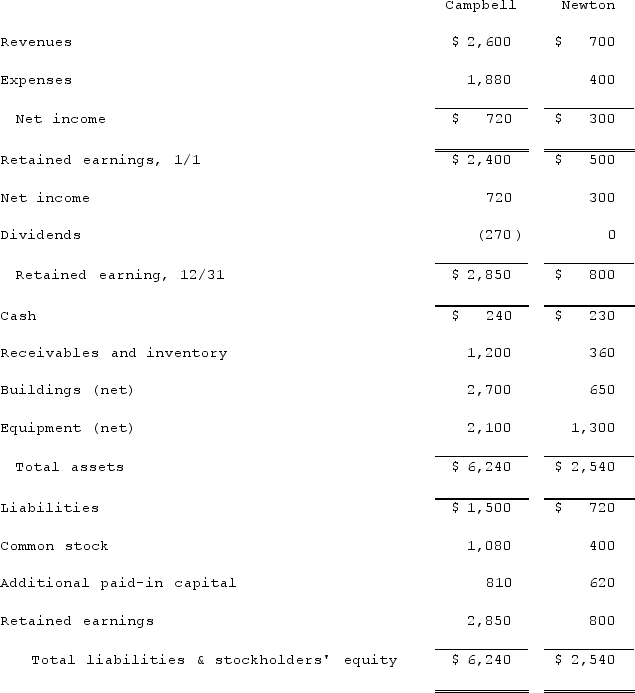

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands) :  On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Assuming that Newton retains a separate corporate existence after this acquisition, at what amount is the investment recorded on Campbell's books?

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Assuming that Newton retains a separate corporate existence after this acquisition, at what amount is the investment recorded on Campbell's books?

Definitions:

Q15: Which of the following statements is true?<br>A)

Q26: Predatory pricing is illegal under the Robinson-Patman

Q27: Which of the following is a combination

Q35: Pell Company acquires 80% of Demers Company

Q42: To prove predatory pricing,it must be proved

Q62: Stark Company, a 90% owned subsidiary of

Q103: Pell Company acquires 80% of Demers Company

Q110: Colbert Inc. acquired 100% of Stewart Manufacturing

Q117: Patti Company owns 80% of the common

Q123: Pell Company acquires 80% of Demers Company