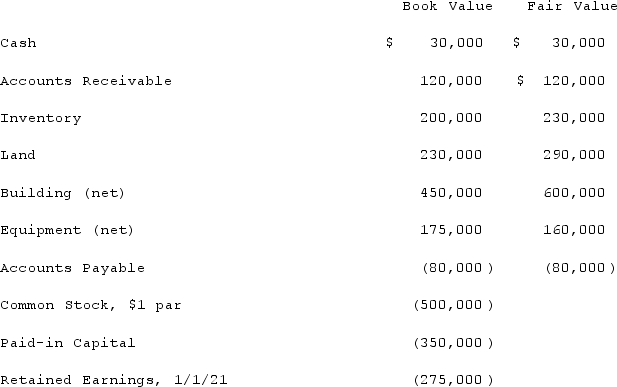

On January 1, 2021, Chester Inc. acquired 100% of Festus Corp.'s outstanding common stock by exchanging 37,500 shares of Chester's $2 par value common voting stock. On January 1, 2021, Chester's voting common stock had a fair value of $40 per share. Festus' voting common shares were selling for $6.50 per share. Festus' balances on the acquisition date, just prior to acquisition are listed below.  Required: Compute the value of Goodwill resulting from the acquisition.

Required: Compute the value of Goodwill resulting from the acquisition.

Definitions:

Q5: Which of the following helps determine what

Q17: In a step acquisition, which of the

Q20: Which statement is true of networking?<br>A) Approaching

Q22: Which of the following best defines the

Q27: Pot Co. holds 90% of the common

Q46: An upstream sale of inventory is a

Q46: Daniels Inc. acquired 85% of the outstanding

Q58: Scott Co. paid $2,800,000 to acquire all

Q72: How does the use of the equity

Q117: On January 3, 2020, Baxter, Inc. acquired