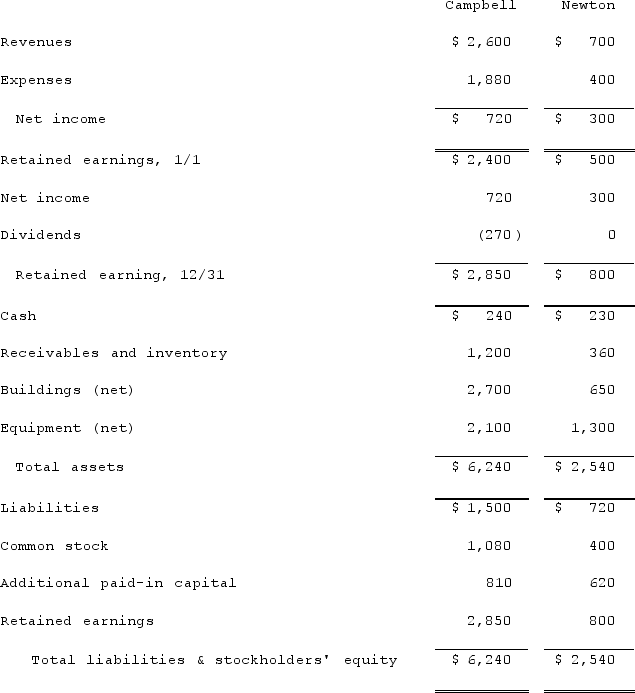

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands) :  On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated liabilities at December 31, 2021.

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated liabilities at December 31, 2021.

Definitions:

Discharge Instructions

Directions provided by healthcare professionals to a patient upon discharge from hospitalization or a medical procedure, detailing care and activities to follow at home.

Grade Level

The classification of school levels in educational systems to organize students by their year of study.

Sterile Technique

Strategies and practices employed to maintain sterility during medical procedures, minimizing the risk of infection.

Dressing Change

The process of removing old wound dressings, cleaning the wound, and applying new dressings for the purpose of promoting healing and preventing infection.

Q1: Wilkins Inc. acquired 100% of the voting

Q4: Return on investment (ROI)for a firm is<br>A)

Q8: Pell Company acquires 80% of Demers Company

Q39: Which of the following statements is true

Q47: Which of the following statements is true

Q55: Why do intra-entity transfers between the component

Q56: Kaye Company acquired 100% of Fiore Company

Q65: Poole Co. acquired 100% of Mullen Inc.

Q91: On January 1, 2021, Doyle Corp. acquired

Q92: Several years ago, Polar Inc. acquired an