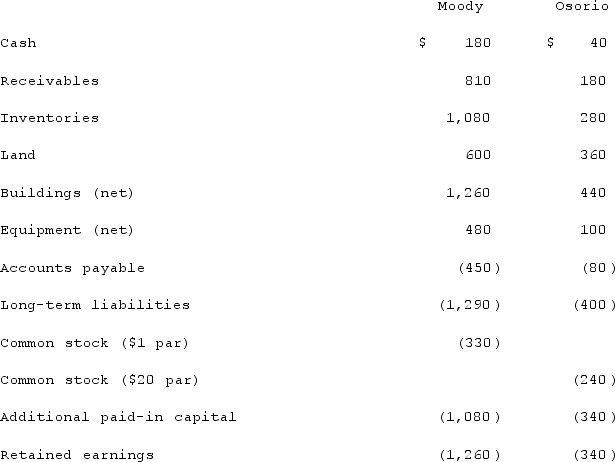

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated common stock at date of acquisition.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated common stock at date of acquisition.

Definitions:

Account Payable

Liabilities of a business that are owed to creditors for goods or services purchased on credit.

Total Assets

The sum of all assets owned by a company, including both current and non-current assets.

Accounting Systems

A structured process of collecting, recording, summarizing, and reporting financial transactions for a business or organization.

Common Shares

Equity securities representing ownership interests in a corporation, entitling holders to dividends and certain rights under corporate governance.

Q2: On January 3, 2020, Trycker, Inc. acquired

Q18: On January 3, 2021, Madison Corp. purchased

Q23: Which of the following is a guideline

Q34: In an acquisition where 100% control is

Q73: On January 4, 2021, Snow Co. purchased

Q77: Inelastic demand is a situation in which<br>A)

Q85: On January 1, 2021, Kapoor Co. sold

Q94: Jackson Company acquires 100% of the stock

Q106: When consolidating a subsidiary that was acquired

Q116: In measuring the noncontrolling interest immediately following