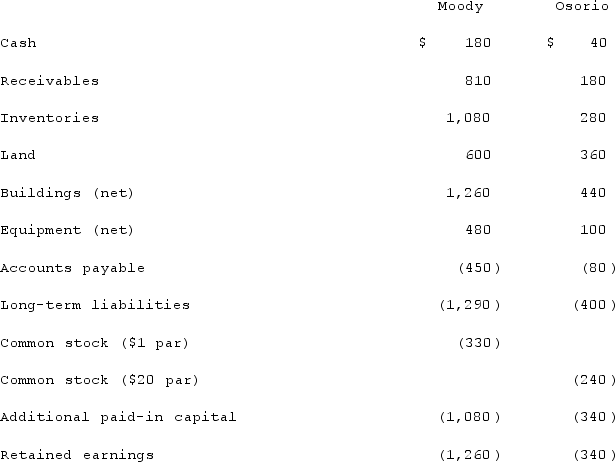

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated inventories at date of acquisition.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated inventories at date of acquisition.

Definitions:

Shock

A medical condition characterized by a significant reduction in blood flow, leading to cellular dysfunction and organ failure.

Caller on Hold

Refers to a caller who is temporarily suspended on the telephone line, awaiting assistance or connection to the desired party.

Practice Name

The name under which a professional practice, such as medical, legal, or dental, operates or is known.

Wait Duration

The length of time a patient or individual has to wait before receiving services, attention, or results in various settings.

Q38: According to Charlene Li and Josh Bernoff

Q52: On January 1, 2019, Palk Corp. and

Q53: What should an entity evaluate when making

Q69: Which of the following variable interests entitles

Q71: Under the partial equity method, the parent

Q74: Milton Co. owned all of the voting

Q83: Profit-oriented pricing objectives include _.<br>A) target return

Q88: Adequate distribution for a new product can

Q107: How does a gain on an intra-entity

Q109: Kaye Company acquired 100% of Fiore Company