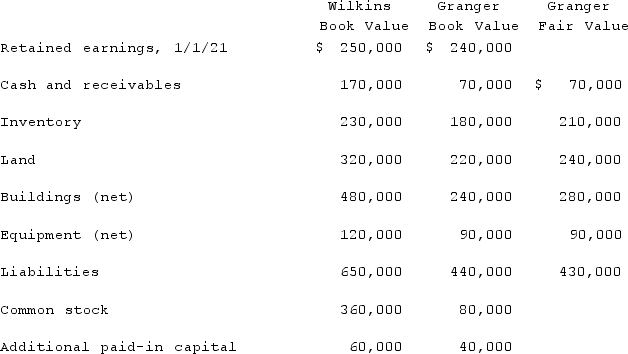

Wilkins Inc. acquired 100% of the voting common stock of Granger Inc. on January 1, 2021. The book value and fair value of Granger's accounts on that date (prior to creating the combination) are as follows, along with the book value of Wilkins's accounts:  Assume that Wilkins issued 13,000 shares of common stock, with a $5 par value and a $46 fair value, to obtain all of Granger's outstanding stock. In this acquisition transaction, how much goodwill should be recognized?

Assume that Wilkins issued 13,000 shares of common stock, with a $5 par value and a $46 fair value, to obtain all of Granger's outstanding stock. In this acquisition transaction, how much goodwill should be recognized?

Definitions:

Implicit Interest

The cost of borrowing that is not explicitly stated as an interest rate, often factored into the terms of leases or other financial agreements.

Face Value

The nominal or dollar value printed on a security, such as a bond or stock, representing its legal worth.

Effective Annual Yield

The interest rate on an investment or loan, which is compounded more than once per year, represented as an annual rate.

Interest Payment

The payment made by a borrower to a lender as compensation for the use of borrowed money, typically calculated as a percentage of the principal.

Q14: Fesler Inc. acquired all of the outstanding

Q20: On January 1, 2021, Parent Corporation acquired

Q35: King Corp. owns 85% of James Co.

Q40: Unlike advertising and sales promotion,in personal selling,responses

Q54: Dayton, Inc. owns 80% of Haber Corp.

Q67: Wilkins Inc. acquired 100% of the voting

Q70: During off-season,the Rues Hotel offers a 25

Q81: Pell Company acquires 80% of Demers Company

Q117: Which of the following statements is true

Q126: Pell Company acquires 80% of Demers Company