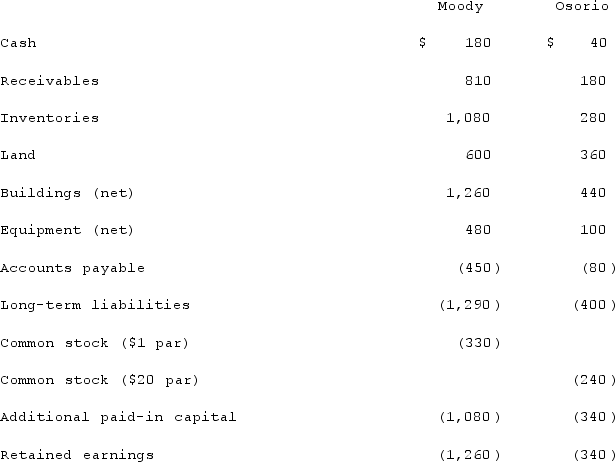

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated equipment at date of acquisition.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated equipment at date of acquisition.

Definitions:

Contingent

Dependent on certain conditions or situations; not absolute.

Employee Recognition Programs

Formal schemes implemented by organizations to reward and acknowledge the achievements and contributions of their employees.

Employee Engagement

The emotional commitment an employee has to their organization and its goals, often resulting in higher productivity.

Visible Reward

A tangible recognition or reward that is easily seen and recognized by others, often used as an incentive in various settings.

Q6: Kaye Company acquired 100% of Fiore Company

Q10: Which of the following is NOT true

Q24: How does the partial equity method differ

Q29: Which of the following is true of

Q52: Flax Co. acquired 80% percent of the

Q64: Lead qualification is the identification of the

Q78: Which of the following refers to net

Q83: When a company has preferred stock in

Q94: What is the impact on the noncontrolling

Q115: An intra-entity transfer took place whereby the