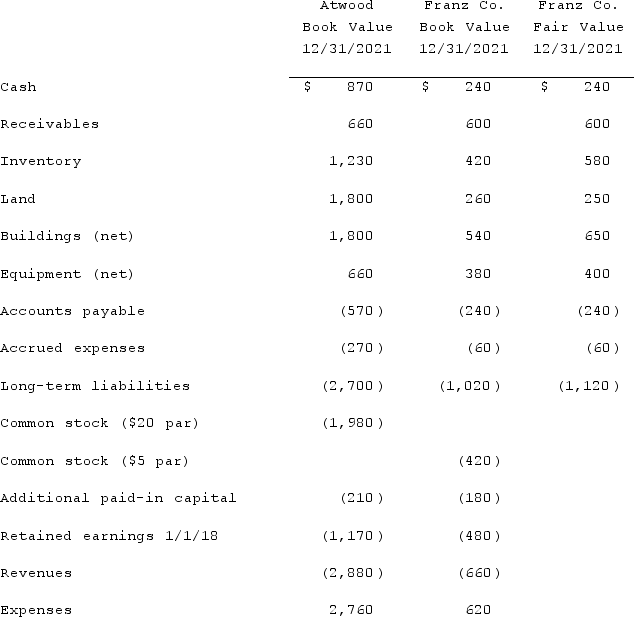

The financial statement amounts for the Atwood Company and the Franz Company as of December 31, 2021, are presented below. Also included are the fair values for Franz Company's net assets (all numbers are in thousands) .  Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31, 2021. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Compute consolidated equipment (net) at the date of the acquisition.

Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31, 2021. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Compute consolidated equipment (net) at the date of the acquisition.

Definitions:

Deferring Consumption

The act of postponing spending money on consumption goods to save or invest for future use.

Interest

The cost of borrowing money, usually expressed as a percentage of the amount borrowed, paid over a specific period.

Dividend

A portion of a company's earnings distributed to shareholders, usually in the form of cash or additional shares.

Wage

The fixed regular payment, typically paid on a daily or weekly basis, made by an employer to an employee, especially to a manual or unskilled worker.

Q22: Presented below are the financial balances for

Q26: Predatory pricing is illegal under the Robinson-Patman

Q56: Virginia Corp. owned all of the voting

Q58: Pepe, Incorporated acquired 60% of Devin Company

Q70: During off-season,the Rues Hotel offers a 25

Q75: The balance sheets of Butler, Inc. and

Q79: McGuire Company acquired 90 percent of Hogan

Q95: Which of the following statements is true

Q103: Flintstone Inc. acquired all of Rubble Co.

Q127: Pell Company acquires 80% of Demers Company